Unless you have been living under a rock for the last few months, there is no doubting that you will have heard of Marie Kondo and her decluttering philosophy that has changed the way many of us around the world clean and organise our homes! Thanks to Marie, we all have much cleaner and calmer living environments, but what about applying that same philosophy to your finances? Here is how to give your finances a Marie Kondo makeover!

1. Categories

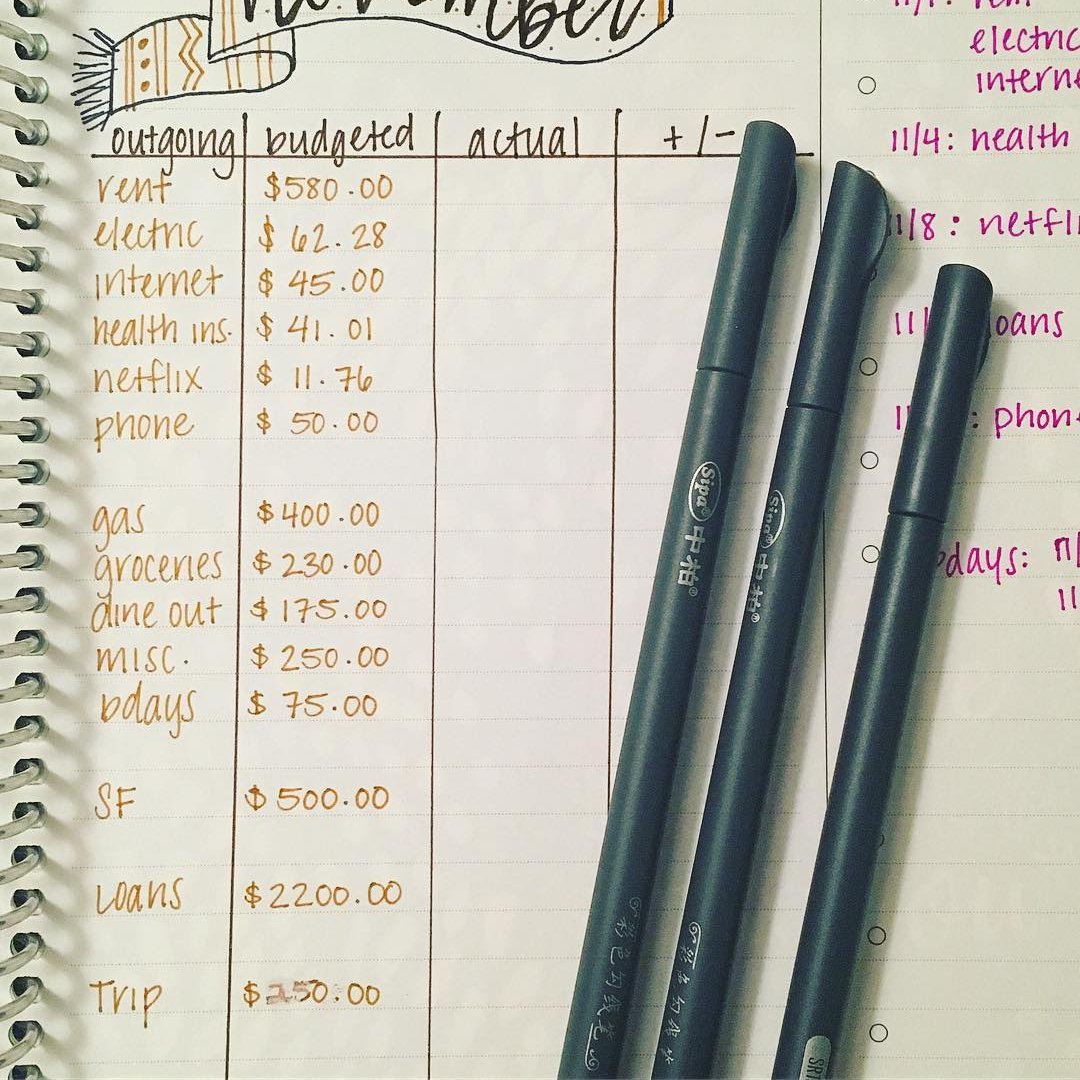

Sit down and work on creating your own list of financial categories. Divide things up into lists like living expenses, savings, and fun, and you will soon start to see where your biggest outgoings occur, where your most important financial decisions and responsibilities are. It just gives you a much clearer picture of where your money is going every single month.

2. Set Specific Goals

To help you come to terms with your finances and have a much clearer vision for the future, you should also work on writing a list of financial goals that you want to achieve. Things, like get out of debt, start an emergency fund, have insurance, and paying into a pension, are all super important, so it can be helpful to have them written down in a physical manner. When you have identified all of your goals, you can decide on an amount of money that you need to set aside for them each month. It does not good to have your head in the sand and live from pay check to pay check.

Frequently asked questions

3. Clean out Expenses

This is one of the most revelatory actions to take. Write a list of all of your expenses, from the big things like petrol to non-essential likes Netflix or Spotify. Once you have a list in front of you of everything you are spending money on each month, you can then make some tough decisions about which subscriptions and expenses to cut back on and cancel. You would be amazed by how many people pay money each month for memberships and subscriptions that they don’t even use.

4. Emergency Fund

It is super important that you start putting some money aside each month to create an emergency fund. From medical expenses to insurance problems to a broken boiler, you never know what kind of financial trouble you might run in to tomorrow, so it can give you huge peace of mind to know that you have a little bit of cash stashed away just for emergencies like that.

Your credit score isn’t just a number—it’s a reflection of your financial habits. Want to improve it smartly? Credit Score GPT helps you track and upgrade your credit profile with precision.

5. Consider Your Joy

Back to the trademark Marie Kondo style, you need to have a long, hard think about what you are spending your money on, and whether those things bring you joy or not. Of course, the essentials like rent and bills aren’t joyful, but they are unavoidable, it is more the non-essentials that I’m alluding to with this. If you are paying weekly or monthly for something that doesn’t bring you joy, and you have the power to stop it, then stop it!